Why The Spandex Fiber Price So Expensive

A Decade High Price of Spandex, What are reasons behind?

Since this year, commodity prices rising excessively fast has brought impact on China’s downstream entities, which has aroused great concern from all sides. The executive meetings of the State Council have repeatedly emphasized the deployment of a good job to ensure the supply and stabilize the price of commodities, and has achieved initial results. However, with the improvement of the global epidemic and the gradual recovery of oil demand, domestic and foreign crude oil futures prices rose in tandem. As a result, the chemical fiber raw material market remained generally firm.

The spandex, known as “MSG” in the textile industry, has recently continued to rise in price and went viral, causing much attention.

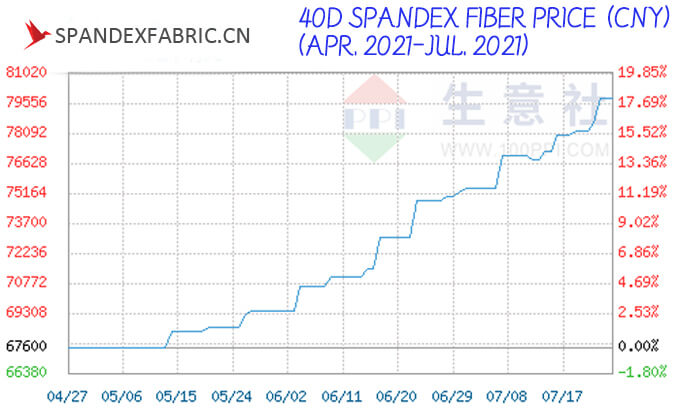

Data show that, at present, spandex stock supply is still tight in Shandong, Zhejiang, Jiangsu, Fujian and other places, continuing to hand over the previous orders. Some manufacturers are not taking new orders for the time being, mainly supplying quality customers. In terms of price, on 12 July, the price of 40D spandex was RMB 77,000/ton, up RMB 1,600/ton from the price at the beginning of July, up RMB 9,400/ton from 3 months ago, up by 13.91%, and up by 156.34% from the average price in the same month last year. 40D spandex price as a whole is on an upward trend.

Currently, the price of spandex has reached new heights in 10 years. A practitioner of the industry for many years lamented that over the years, spandex prices are also fluctuating, but an increase of more than RMB 60,000/tonne is rarely the time. This ongoing round of price increase is unprecedented.

So, what has led to the current round of spandex price increases? What will happen to spandex prices in the future?

▲40D Spandex Fiber Price

Tight supply and demand-A dynamic application range for spandex

As consumer attitudes change and consumer demand grows, consumers demand more and more sports and leisure apparel and have higher and higher functional requirements for clothing. Fabrics containing spandex are widely used in professional sportswear, swimwear and protective clothing due to their excellent elasticity, acid and alkali resistance, sweat resistance, seawater resistance and abrasion resistance, making spandex stretch fabrics increasingly popular in the market. And this spandex price increase, can not be separated from the support of the demand. The shortage of spandex supplies in the market and the factory low stock drive its price further up.

” A very important reason for the current round of spandex price rise is the tight supply and demand.” spandex industry analyst Gong Yuqian of Zhuo Chuang Information told the correspondent of “Securities Daily”. On the demand side, post-pandemic domestic textile and clothing demand recovery plus the transfer of foreign orders have driven spandex demand to increase. On the supply side, due to the low price of spandex in the past few years , the industry accelerated reshuffling, and many old maturerers of old and low capacity were eliminated from the game. The supply and demand pattern of spandex was changed from overcapacity to tight supply.

The growth on the demand side was clearly felt by spandex companies. “After the pandemic, we can clearly feel the significant increase in demand for spandex from customers in the medical field such as mask ear belts and protective clothing, while the market in this part was previously small.” Liu Jianning of Taihe New Material securities department told the Securities Daily correspondent, that the pandemic led to more time spent at home by the masses and increased health awareness, leading to an increase in the application of spandex in home sportswear and casual sportswear, as well as more adequate orders in the textile industry, all leading to rapid growth in spandex demand.

In addition to the growth in domestic demand, affected by the COVID-19 pandemic, exports from the garment industry in Southeast Asian countries shrank severely and some orders for textiles were transferred to China, further pushing up the demand for spandex. Customs statistics show that in September 2020 ~ May 2021, China’s cumulative exports of textiles and garments amounted to US$216.725 billion, an increase of 13.74% year-on-year, of which the cumulative exports of textiles amounted to US$105.230 billion, an increase of 6.47% year-on-year; the cumulative exports of garments amounted to US$111.495 billion, an increase of 21.56% year-on-year. In particular, from January to May this year, China’s cumulative exports of garments amounted to US$56.612 billion, an increase of 48.33% year-on-year.

“The growth in demand for spandex can also be proven from the starting rate of downstream weaving machines.” Gong Yuqian told Securities Daily. As of June 24, the start rate of circular and warp knitting machines in Zhejiang was 61% and 87% respectively, an increase of 11 and 17 percentage respectively compared to the same period last year. In the first half of this year, the start rate of circular and warp knitting machines was 53% and 72% respectively; while in the same period of 2020, affected by the pandemic, the start rate of circular and warp knitting machines was only 33% and 34%.

“In addition, the rise in the price of raw materials is also an important factor in the price increase of spandex.” Gong Yuqian said. During the the first half of this year, the average price of PTMEG, the main raw material for spandex, reached 34,515.5 yuan per tonne, up by 99% compared to the same period last year, and the average price of MDI, another raw material, also rose by 55%, the rising cost is an important factor in the price increase of spandex.

Continued strong demand from downstream-Leading companies see sharp rise in profits

In the general background of the positive market, the market performance of spandex manufacturers is also very impressive. One of the leading domestic spandex enterprises, Taihe New Material announced a half year performance forecast on the evening of July 6. The company is expected to achieve a net profit attributable to shareholders of the listed company of 400 million yuan to 450 million yuan in the first half of 2021, an increase of 222.45% to 262.76%. The announcement said that since this year, the demand for spandex industry has continued to be strong. The concentration of production capacity has increased significantly. The price of spandex has continued to rise, and the profit level has increased significantly year-on-year.

▲The Commodity Price Increasing

On July 9, Huafon Chemical (002064.SZ) released its 2021 semi-annual performance preview, saying the company expects to achieve a net profit attributable to shareholders of the listed company of about 3.6 billion yuan to 3.9 billion yuan in the first half of the year, an increase of 441.31% to 486.42% over the same period of the previous year.

Financial data show that in 2020, the company achieved operating revenue of 14.724 billion yuan, a slight increase of 6.81% year-on-year; achieved net profit attributable to shareholders of the listed company was 2.279 billion yuan, an increase of 23.77% year-on-year, after deducting non-recurring gains and losses its earning was 2.194 billion yuan, up by 348.63% year-on-year from the previous year. During the first quarter of 2021, its operating revenue increased by 120.77% to RMB 5.794 billion, and net profit attributable to shareholders of the listed company rose by 501.67% year-on-year to RMB 1.64 billion.

It is estimated that Huafon Chemical’s profit in the first half of the year exceeded the annual profit of 2020. Meanwhile, a rough estimate shows that in the second quarter of this year, the company is expected to achieve a net profit attributable to shareholders of the listed company of approximately RMB 1.96 billion to RMB 2.26 billion, an increase of 19.51% to 37.8% over the first quarter on a sequential basis.

Regarding the performance growth, Huafon Chemical explained that during the reporting period, the industry downstream demand recovered and the boom continued to rise. The yield, sales and price of the company’s leading products in the half-year of 2021 have increased substantially compared with the same period of the previous year. At the same time, the company has strengthened cost control and effectively resolved the fluctuation of raw material prices. The company’s overall gross profit margin increased significantly and achieved a greater year-on-year increase in operating conditions and earnings.

On July 12, Xinxiang Chemical Fiber released a performance preview. The company is expected to achieve a net profit of 710 million to 760 million yuan in the first half of the year, an increase of 2394.14% to 2569.79% over the same period of the previous year, the net profit of 28,466,700 yuan in the same period of the previous year. Although somewhat affected by the low baseline for the same period in 2020, the net profit of more than 700 million yuan in the first half of the year is substantial.

“During the reporting period, influenced by the sustained growth of the basic demand of the spandex industry, the price of the company’s major product, spandex fiber, increased significantly compared with the same period of the previous year. sales volume increased significantly and the gross profit margin of the spandex business increased significantly. The company’s half-year results increased considerably compared with the same period of the previous year.” Xinxiang Chemical Fiber performance preview noted.

Industry inventories continue to remain low-Spandex prices may reach new record highs

China is currently the world’s largest producer and consumer of spandex. According to the 2020 Spandex Industry Chain Annual Report published by the China Chemical Fiber Information Network, global spandex production capacity was 1.223 million tonnes in 2020, of which China’s domestic production capacity accounted for approximately 71%.

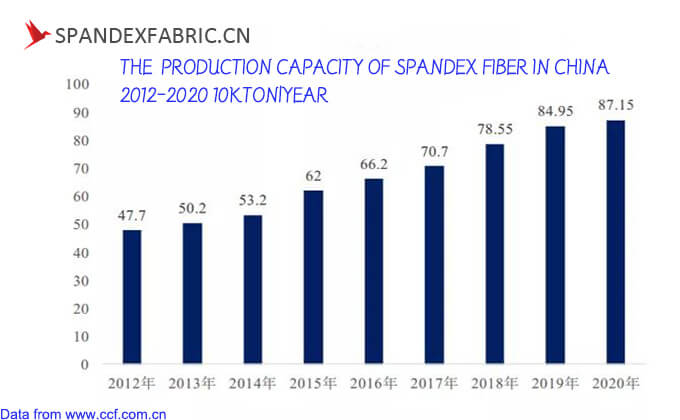

▲The Production Capacity Of Spandex Fiber in China

Spandex has seen such a strong increase in price this year, mainly because spandex production capacity is growing at a slower rate than the growth in demand. Spandex production capacity grew from 165,000 tonnes in 2004 to 785,500 tonnes in 2018; by 2019 China’s spandex production capacity reached 849,500 tonnes, an increase of 8.1% year-on-year; last year in 2020 China’s spandex production was 871,500 tonnes, an increase of only 22,000 tonnes, or 2.59% year-on-year.

And in recent years, China’s apparent consumption of spandex rose every year to reach 681,000 tons in 2019, and China’s apparent demand for spandex grew to 782,900 tons in 2020, up by 14.97% year-on-year. In addition spandex exports also affected the domestic supply of spandex, according to statistics, in 2019 China’s spandex exports amounted to 74,000 tons, up by 28.2% year-on-year; in 2020 China’s spandex exports amounted to 78,500 tons, up by 6.08% year-on-year, an increase of 2.59% on the supply side, compared to 14.97% on the demand side and 6.08% on the export side. The “demand exceeds supply” situation is emerging, and production and sales are naturally pushing companies to expand production.

Since this year, Huafon Chemical has accelerated the pace of capacity development. On May 14, Huafon Chemical released a plan for a non-public offering of A shares in 2021, stating that the company intends to issue not more than 1.390 billion shares ( no more than 30% of the company’s total share capital before this issue) to not more than 35 selected investors, raising total capital of not more than 5 billion yuan, which will be used to invest in the construction of an annual output of 300,000 tons of differentiated Spandex extension project (RMB 2.8 billion) and 1.15 million tons/year adipic acid extension project (Phase VI) (RMB 2.2 billion).

Although many leading enterprises are already in the construction of production capacity, but the most recent production will have to wait until the end of November this year, spandex is currently facing a tight supply, which is still inevitable. In particular, the peak season in the second half of the year will inevitably see spandex prices rise and fabrics rise as well. In addition, the global pandemic is still ongoing, prevention of epidemic supplies such as: masks, protective clothing, medical bandages and other demand for spandex in the future also have a certain growth. Even if new production capacity is put into operation at the end of the year, it may be difficult to meet the additional demand.

“The current industry supply and demand remains very tight, with industry inventories continuing to remain at a minimum level of 12~14 days.” Guosen Securities analysts believe that spandex industry expansion in the future is mainly concentrated in the industry’s leading manufacturers, and new production capacity is mainly put in the second half of the year. The spandex industry in the second half of this year will still maintain a high industry boom. Product prices in the third quarter may still be a record high again.

“As of now, the effective domestic production capacity is about 870,000 tonnes. Although there are more new plans of adding capacity, they are mainly concentrated at the end of the year or next year, and the spandex boom is expected to continue in the short term.” Gong Yuqian said that if the new capacity is implemented as planned, it is expected to reach 1 million tonnes by the end of 2021, with a growth rate of nearly 15%, which will then effectively ease the tight spandex capacity.